Wednesday, June 3, 2015

High Dividend Stocks to Watch in 2015: AT&T, STMicroelectronics, Frontier Communications, HCP, and more

AT&T

Currently at about a halfway point between it's 52 week high and low. It has one of the highest dividends for a major U.S. corporation. Compared to other industry competitors (T-Mobile and Verizon) it does have a high PEG ratio of 3.06, which could mean AT&T's growth is slowing.

5.4% dividend yield

6/2/15 price: 34.36

S = Sprint Corporation

TMUS = T-Mobile US, Inc.

VZ = Verizon Communications Inc.

Industry = Telecom Services - Domestic

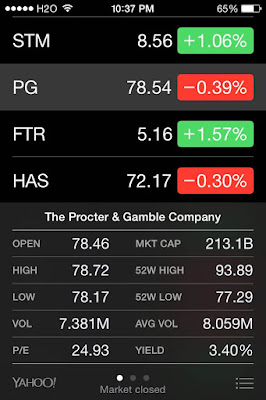

STMicroelectronics

It has a good PEG (5 yr expected) of 0.66 and a more desirable number than it's industry competitors.

4.7% Dividend Yield

IFNNY = Infineon Technologies AG

NXPI = NXP Semiconductors NV

TXN = Texas Instruments Inc.

Industry = Semiconductor - Broad Line

Frontier Communications

Only slightly above its 52 week low, it might be time to buy FTR. Be aware that the company's 5 year expected PEG is 8.23.

8.2% divident yield

6/2/15 price: 5.16

CenturyLink

Although currently within 1% of its 52 week low, it has a worrisome PEG and P/E ratio, but if you're willing to take a risk to earn a high dividend, CenturyLink might be for you. It's 5 year low of 28.79 happened just 15 months ago in February 2014.

6.4% dividend yield

Procter & Gamble

A solid blue-chip stock, Procter and Gamble is not going anywhere. Their company has one of highest dividend yields of a blue-chip stock. At only 1% above it's 52 week low, it's one to keep an eye on, especially if the U.S. enters a mini recession.

3.4% dividend yield6/2/15 price: 78.54

High Dividends from more blue chip stocks:

5.8% HCP

5.4% RRD - printing company

3.22% Coca-Cola

3.2% Lockheed Martin

3.0% Johnson & Johnson

3.0% Merck

2.93% Pepsi

2.9% UPS

2.5% H&R Block

Why buy HCP stock?

HCP (HCP) is structured as a real estate investment trust, but focuses mainly on healthcare real estate including senior housing and medical offices. HCP has the mandate to deliver at least 90% of its taxable income back to shareholders in the form of dividends, which translates into a big dividend yield.

Those are payouts you can bank on. Indeed, HCP has paid uninterrupted dividends since 1985, landing it a place on InvestorPlace’s list of dependable dividend stocks.

via: 5 High-Dividend Blue-Chip Stocks to Buy | InvestorPlace

Read more about stocks that will earn more dividend interest than money sitting in your savings account.

High Dividend Stocks List : Stocks That Pay Dividends | InvestorPlace

3 Preferred Stocks to Own With 6% Dividends | InvestorPlace

5 High-Dividend Blue-Chip Stocks to Buy | InvestorPlace

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Only comments in English will be considered. Thank you!