Blackstone Announces Major Asset Liquidations As Redemption Requests For Its REIT Continue

Monday, November 13, 2023

Tuesday, August 8, 2023

Sunday, March 5, 2023

Michael Burry's Most Important Tweets of 2023

(The Y-axis shows uninsured deposits greater than $250k at major banks. The X-axis shows the realized losses percentage of CET1 Capital.)

Sunday, February 26, 2023

Sunday, January 15, 2023

iBonds are paying a hefty 6.89% until April 2023

Thursday, October 13, 2022

PMCC - Poor Man's Covered Call Explained

Friday, October 7, 2022

MSFP - Masters of Science in Financial Planning

Students in the MSFP program receive a strong foundation in financial planning principles using sound, ethical, business practices, and have the option to choose one of three concentrations representing the fastest-growing and most relevant fields in financial services today: Financial Planning, Retirement Planning, or Legacy Planning."

Monday, September 26, 2022

15-50 Rule of Investing

Tuesday, September 20, 2022

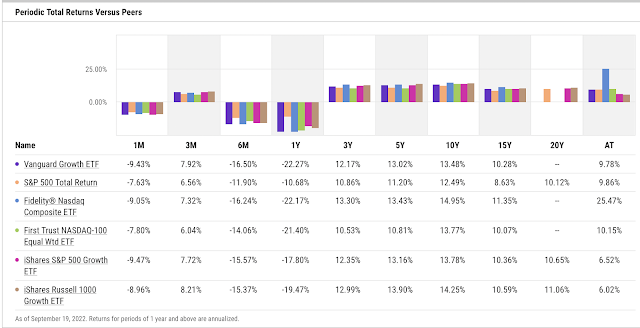

YCharts.com - see performance of funds in the same category

YCharts.com

Periodic total return (including 5, 10, and 20 year percentage returns).

Cumulative Total Returns Versus Peers

Monday, September 12, 2022

How Much to Save for Retirement and Financial Order of Operations - Money Guy Show

Sunday, July 31, 2022

Investment Returns from 15 Years in the S&P 500 index (from July 2005 to July 2020)

The S&P 500 investment calculator can help you see hypothetical market returns over time.

Investing in the S&P 500 from July 2005 to July 2020 and merely investing $100 per month would have grown $18,000 to a whopping $41,905. After capital gains taxes, this would have been closer to $38,889.

This period of 15 years would have provided an annualized return of 10.59%.

Here's the breakdown, as a screenshot from their website:

A comparative annual return of 9% would have yielded $38,124 (using Nerd Wallet's investment calculator).

Friday, May 6, 2022

Yearly salary - per workday pay equivalents

Thursday, March 17, 2022

When is coffee a deductible business expense?

The deduction for business meals changed in 2021 and 2022 to encourage business owners to patronize restaurants, coffee shops, and more.

See all the rules here: Is your coffee a tax write-off?

In essence, you must be meeting with a client, or providing the coffee to a client or employees to write off the coffee as a business expense. In 2021 and 2022, business meals are 100% deductible, whereas in previous years it was only a 50% deduction.

Tuesday, March 15, 2022

Getting Rich with the TSP

Monday, November 29, 2021

High home prices in Bozeman, MT

Normal families, couples, and individuals have been forced out of the Bozeman Real Estate market because there is almost nothing available for under $400,000 now.

To qualify for a $400,000 condo (which has stricter lending requirements than a Townhome), a buyer would need to have:

* Annual income around $80,000-85,000

* No debt (ie: no student loans and no car payment)

* $20,000 down payment

In 2019 and early 2020 before Covid and a flood of cash buyers hitting the local market, plenty of 2 and 3 bedroom condos and townhomes were available for $400k or less.

Early December 2021 Listings under $550,000.

Two bedroom condos are now approaching $400,000.

A centrally located 2 bedroom condo with 1,088 sqft is listed for $385,000. It was built in 2004.

And another 2 Bedroom condo located just west of the Bozeman Pond is 1,210 sqft for $399,900.

$330 per square foot. This home was built in 1997 and is already almost 25 years old!

Very curious to see if these properties actually sell for these astronomical prices. A family of three would likely avoid these properties because of growing pains. A single person or a couple could be comfortable in these spaces, but they would need to be okay with a one car garage and minimal space for storage.

A minimalist could thrive in these spaces, but if the person didn't care about living in the main areas of Bozeman, they could buy a Tiny Home on a small plot of land 10-20 miles from the city for about half this price (or less).

Samples of current home price listings in November 2021

4276 Monroe St #B

$385,000

2 BR 2 BA and 1,190 sqft

That's $323 per square foot and only a 2 bedroom condo that part of a four unit complex.

This new construction on Baxter Creek way near the new high school is massively inflated, and sadly, most of these units are probably already sold since not many properties are available near the city center right now.

1020 Baxter Creek Way Unit B

$520,000

3 BR 3 BA, and 1,572 sqft

$330 per sqft and this place only has a one car garage.

Without pooling two incomes, this place would be very difficult to buy for a normal family. You would need a six figure income or a huge pile of cash to buy this place.

$510,000

3 BR 2 BA and 1,548 sqft

$329 per square foot for a central location that is about 10 minutes to downtown in normal traffic. This home looks nice, but it's a basic 3 bedroom condo for a half a million dollars. A prime example of Bozeman's real estate market getting inflated by cash buyers, low supply, and high demand.

Thursday, October 28, 2021

Last Will packages from Legal Zoom

Legal Zoom's will packages are as cheap at $89 for a basic Will that includes free revisions for 30 days after purchase. The prices below were captured on 10/28/21.

Click on the image to view full size.

Spending an additional $10 will provide 2 weeks of legal questions answered by their attorneys.

Monday, October 25, 2021

Federal Taxes and Montana Taxes for Active Duty or Combat Zones

Military Members in Combat Zones do not pay Federal Taxes

Although any base pay earned by a member of the armed services while serving in a combat zone is excluded from federal income tax, it is still subject to Social Security tax and Medicare tax.- For enlisted service members, the amount of the exclusion from federal income tax is unlimited.

- For officers, the exclusion is limited to the maximum amount of enlisted pay.

- States vary on whether or not the federal combat pay tax exclusion applies to state income taxes.

source: QuickBooks: Combat Pay, Tax Style: Benefits When Serving in a Hot Zone

Montana does not tax active duty pay.

(2) (a) The salary received from the armed forces by residents of Montana who are serving on active duty in the regular armed forces and who entered into active duty from Montana is exempt from state income tax.

Source: Montana Tax

Friday, May 7, 2021

Real Estate in Silicon Valley - Parkington Ave

1151 Parkington Ave

Sunnyvale, CA 94087

Basic, three bedroom tract home built in the early 50s. Modest backyard with some landscaping.

Realtor.com estimates:

Median est. home value: $1,858,800.

Median neighborhood price: $1,990,000

Collateral Analytics: $1,603,000

Core Logic: $1,858,800

Quantarium: $1,984,000

Zillow estimate: $2,106,000

Average of Realtor media and Zillow estimates: $1,982,000

Saturday, April 3, 2021

Building Wealth with VA Home Ownership

A service member I chatted with recently said that she has bought three properties with VA loans. When first hearing about these loans, they sounded so special that I was shocked to learn that they can be used multiple times.

Own a new property every two years!

National Guard members who have served for six years or were on active duty for 90 days also qualify for VA loans. A young person who joined in their 20s could become a homeowner more easily before age 30.

After buying my first home (with a conventional loan) in 2021, I plan to buy a second home in 2024 or 2025 after qualifying for a VA loan. Then we'll live in the new home and rent out the first (small) home that we purchased. By that point, the rents in the hot rental market where will live will likely reach the point where the renter is paying our entire mortgage.

And if we want to, we could rinse and repeat the same process to buy a third home.

After owning three properties for 10-15 years, we could cash out of the first two homes. Then live off of the profits of those sales until retirement when our 401Ks and Roth IRAs would accessible.

Use Zillow or a Property Management Agency to Find Reliable Tenants

A buddy (non-service member) who just bought his second home in Bozeman, MT was able to use Zillow's Rental Application Form to find qualified renters in less than a month, on multiple occasions.

He rented out his first home, showed the bank the lease, and was able to co-sign with his in-laws to get a single family dream home in the same city! He was expecting a third child and they were outgrowing their original home, a modest 3 bedroom townhome in a newer and desirable neighborhood. He now rents this Townhome for $2,700 per month, which is far more than the total cost mortgage they got in 2014 (7 years ago). Their mortgage, including HOA fees on that rental is only $1,400-1,500 per month.

Not only is his tenant paying their mortgage completely, they are also paying for part of their current mortgage on this nicer home so his family has more affordable living.

This service Zillow offers is free for the homeowner and only costs the renter applying a flat $29, which they can also use to apply to other Zillow rentals within 30 days. This is a big win-win for both landlord and tenant. The landlord has better piece of mind getting the history of the tenant for free, and the applicant does not have to pay high fees to apply to multiple properties.

Some property management agencies swindle big bucks out of applicants in hot rental markets by charging $50, $75, or more to apply, when their costs for the application are almost nothing.

VA Loan Occupancy Requirement Before Renting

Buyers must live in the home for 12 months before renting out the property.

Moving into the VA Loan Home

Generally buyers have 60 days to occupy the property, but up to one year if there is a special circumstance, like a service member who is returning from deployment, or time is needed to perform agreed upon repairs to the property.

"The VA allows for a spouse to fulfill the occupancy requirement for an active duty military member who is deployed or who cannot otherwise live at the property within a reasonable time."

Sunday, January 17, 2021

Single Member LLC vs. a Sole Proprietorship

This article from BizFilings details the advantages and disadvantages of a Single Member LLC vs. a Sole Proprietorship. The primary difference is that the LLC comes with a legal shield and may require more licenses/registrations, depending on the state where it's registered.

Unless the single member LLC has employees, the EIN is the owner's social security number.

LLCs typically do not pay taxes at the business entity level. Any business income or loss is "passed-through" to owners and reported on their personal income tax returns. Any tax due is paid at the individual level.

An article from Entrepreneur magazine: What to Consider When Deciding Between Forming a Sole Proprietorship or LLC